In the world of trading, having the right tools can make all the difference. TradingView is a popular platform among traders for charting and analysis. One of the key features of TradingView is its ability to create custom scripts using Pine Script, which allows traders to develop their own indicators and strategies. In this article, we will explore how to create effective TradingView scripts specifically for swing trading.

Understanding Swing Trading

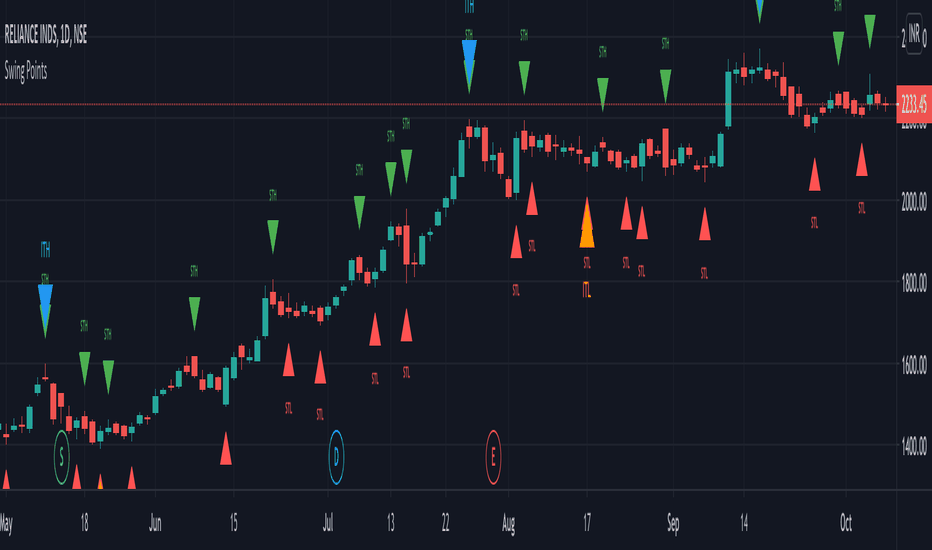

Swing trading is a trading strategy that involves holding positions for a period of days to weeks, aiming to capture short to medium-term gains in a stock or any financial instrument. Unlike day trading, which involves closing out positions by the end of the trading day, swing traders hold positions longer, taking advantage of price swings in the market.

Swing trading is popular among traders who want to avoid the stress of constant monitoring that comes with day trading. This strategy allows traders to analyze market trends and make informed decisions without the pressure of making split-second choices.

By identifying potential price movements and staying patient, swing traders aim to profit from the ups and downs of the market over a slightly longer timeframe. This method requires discipline, risk management, and a good understanding of technical analysis to be successful.

Benefits of Using TradingView Scripts for Swing Trading

Creating custom scripts on TradingView for swing trading can offer several advantages. Firstly, it allows traders to automate their analysis process and receive alerts when specific conditions are met. This can save time and help traders react more quickly to market changes. Additionally, trading scripts can help traders test and optimize their strategies, leading to more informed trading decisions.

Creating custom scripts on TradingView for swing trading can offer several advantages. Firstly, it allows traders to automate their analysis process and receive alerts when specific conditions are met. This can save time and help traders react more quickly to market changes. Additionally, custom scripts can help traders test and optimize their strategies, leading to more informed trading decisions.

By tailoring scripts to individual trading styles and preferences, traders can enhance their overall trading experience and increase their chances of success in the market. Custom scripts can also provide traders with a competitive edge by allowing them to stay ahead of the curve and identify trading opportunities that may not be easily visible through manual analysis.

Furthermore, custom scripts can be continuously refined and updated based on market feedback, improving their accuracy and effectiveness over time. Overall, creating custom scripts on TradingView can empower traders to take control of their trading journey and achieve their financial goals with more confidence and precision.

Key Components of an Effective TradingView Script

When creating a TradingView script for swing trading, there are several key components to consider:

1. Timeframe: Determine the timeframe that best suits your swing trading strategy. This could range from shorter timeframes like 1-hour or 4-hour charts to longer timeframes like daily or weekly charts.

2. Indicators: Choose indicators that are relevant to swing trading, such as moving averages, RSI, MACD, and Bollinger Bands. These indicators can help you identify potential entry and exit points.

3. Entry and Exit Signals: Define clear entry and exit signals based on your trading strategy. This could be a crossover of moving averages, a divergence in an oscillator, or a breakout from a consolidation pattern.

4. Risk Management: Incorporate risk management techniques into your script, such as setting stop-loss orders and defining your risk-reward ratio. This is crucial for protecting your capital and maximizing your profits.

5. Backtesting: Before using your script in live trading, backtest it extensively on historical data to ensure its effectiveness. This will help you identify any potential flaws or areas for improvement.

6. Optimization: Continuously optimize your script based on the changing market conditions and feedback from your backtesting results. This will help you adapt to different market environments and improve your trading performance.

7. Documentation: Properly document your script with comments and explanations to make it easier to understand and modify in the future. This will also be helpful if you want to share your script with other traders.

By considering these key components when creating a TradingView script for swing trading, you can develop a robust and effective tool to assist you in making informed trading decisions.

Examples of Effective Trading View Scripts for Swing Trading

Here are some examples of common TradingView scripts that can be effective for swing trading:

1. Moving Average Crossover: A simple and effective strategy where you can use two moving averages (e.g. 50-day and 200-day) to identify buy or sell signals when they cross over each other.

2. RSI (Relative Strength Index): This indicator can help you identify overbought or oversold conditions in the market, which can be used to time your swing trades.

3. MACD (Moving Average Convergence Divergence): Another popular indicator that helps traders identify trend changes and potential entry or exit points in the market.

4. Bollinger Bands: These bands can help you visualize volatility in the market and identify potential reversal points for swing trading.

5. Fibonacci Retracement: This tool is used to identify potential support and resistance levels based on the Fibonacci sequence, which can be useful for setting profit targets or stop losses.

6. Ichimoku Cloud: A comprehensive indicator that provides information on support and resistance levels, trend direction, and momentum, which can be very useful for swing trading strategies.

Tips for Creating Effective TradingView Scripts

Here are some tips to keep in mind when creating TradingView scripts for swing trading:

1. Define your strategy: Before you start coding your script, have a clear and well-defined swing trading strategy in mind. This will help you determine the specific conditions you want to identify and trade on.

2. Use historical data: Utilize historical price data to backtest your script and ensure its effectiveness in different market conditions. This will help you gauge the performance of your strategy before risking real money.

3. Set clear entry and exit rules: Clearly define the conditions for entering and exiting a trade in your script. This can include technical indicators, price levels, or other criteria that signal when to buy or sell.

4. Consider risk management: Incorporate risk management techniques into your script to protect your capital. This can include setting stop-loss orders, position sizing, and other risk control measures.

5. Optimize performance: Regularly review and optimize your script to improve its performance over time. This may involve tweaking parameters, adding new indicators, or adapting to changing market conditions.

6. Test on different time frames: Test your script on various time frames to ensure its adaptability to different trading environments. This can help you identify the most suitable time frame for your swing trading strategy.

7. Seek feedback: Share your script with other traders or seek feedback from the TradingView community to gather insights and improve your coding skills. Collaborating with others can help you refine your script and make it more robust.

By keeping these tips in mind, you can create more effective TradingView scripts for swing trading and enhance your success in the markets.

Conclusion

Creating effective TradingView scripts for swing trading requires a combination of technical knowledge, trading experience, and discipline. By understanding the key components of a good script, testing it thoroughly, and following best practices, traders can develop scripts that enhance their swing trading strategies and improve their overall trading performance.